The bank had different processes for consumers, small business, and mortgage lending, as well as different processes for different countries. The system often generated inconsistent ratings for customers through each channel; for example, the Web site, call center, and branch might assign different risk levels to the same customer, resulting in different pricing. Similarly, customers might get varying risk assessments for different loan types, even if the collateral and amount were the same, because of inconsistent risk calculations for products. Because the risk calculation was run only at application time, some loans were identified as high-risk (forcing a large loss reserve to be held) when they had, in fact, become lower-risk over time.

A single decision service for credit-rating decisions uses business rules and predictive analytics to ensure consistent customer ratings independent of the system handling sales. This decision service calculates a complete risk profile for a customer across lines of business. The service also performs an expected loss computation and uses all available and relevant data. To prevent any sudden change in creditworthiness, business rules gradually prioritize account activity information and deprioritize generic applicant data over time. In addition, the service allows collateral to support multiple loans, and collateral assignment is handled to minimize expected loss.

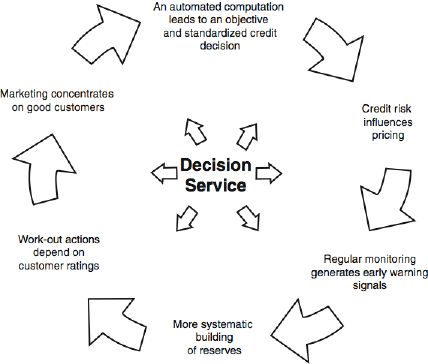

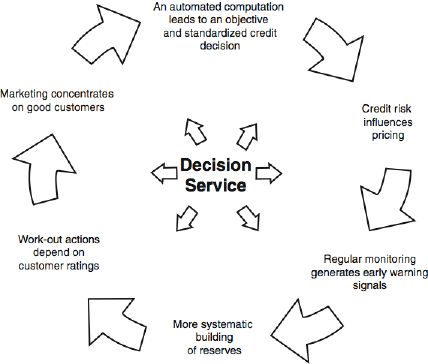

As shown in Figure 1, the decision service has an impact in all aspects of the credit life cycle, from credit decisions to marketing and back to credit decisions. The automated computation of default probability and expected loss leads to an objective and standardized credit decision. Instead of a yes/no decision, the credit risk drives flexible pricing. Regular monitoring of risk levels generates early warning signals at both the single loan level and portfolio level. Expected loss and default probability are important factors for building loan loss reserves. Workout actions can depend on customer ratings, and marketing can concentrate on customers with sufficient creditworthiness. The new system ensures that the bank gets the best possible rating under the new Basel II banking accord.

Note. Basel II is a worldwide banking accord with the stated goal of improving global financial stability by adjusting loan reserves to match risk. The final version, published in June 2004, has an all-encompassing impact on credit and risk management practices.

Figure 1. A central decision service affects all stages of the credit life cycle