The Need for Smart Enough Systems (Part 9): Contributing Value to your ROI Calculation: Strategic Control

Last time, we covered the second of the three layers (cost reduction, revenue growth, and strategic control) that can contribute value to your ROI calculation. In this instalment we explain the third one, strategic control. The third way in which enterprise decision management can show a return is in strategic control. Although putting a monetary value on this control can be hard, organizations adopting this approach can gain a measure of strategic control over their information systems that can offer increased value.

Resource Scalability and Focus

Growing organizations are always looking for ways to increase business without having to add staff in an effort to be more scalable. Being able to acquire new business or new customers without having to scale staff proportionately is helpful. Automating decisions with enterprise decision management can be a key ingredient in this kind of scalability. For instance, an insurance company adopting an EDM approach to underwriting increased its business by 35 percent without hiring more underwriters, thanks to automating key underwriting and renewal decisions.

[Sidebar 1. Leading Computing Hardware Supplier: Preventive Maintenance ]

Delivering this kind of result means refocusing what your expert staff actually does. Instead of using their expertise to rubber stamp large numbers of ordinary transactions, they can focus their time on exceptions, new products, and business growth. If you automate the underwriting decision, underwriters can spend more time on the complicated cases, and the company's risk managers -- the actuaries -- can focus on the overall book of business (the set of all policies written by the company and the corresponding loss reserves and assets backing them), agents' effectiveness, geographic anomalies in results, and emerging trends. They can finally use all those expensive business intelligence tools you bought them. Although this benefit is a qualitative one, it can be important.

Enterprise decision management can also improve focus. Many companies today are trying to outsource some business processes. Manual decision making can make outsourcing hard and reduce its value. You probably don't want to outsource decisions about creditworthiness, risk underwriting, or lifetime profitability potential; they are simply too important. However, you do want to outsource the process that wraps around these decisions, such as the process of printing and sending an offer, collecting paperwork for a loan, and so on. If you focus on automating key decisions in a process, you can decide who should run the process without having to worry about decisions. If you know your team controls the escalation decision for customer complaints, for example, you can outsource the process with less risk and more control.

[Sidebar 2. Re-creating the Corner Store ]

[Sidebar 3. Staffing Reductions ]

Many processes are the same for every organization, except for how key decisions are made. For instance, the process of paying medical claims is essentially identical for all healthcare insurers, but the decisions each insurer makes about paying claims can vary. One insurer might be focused on low cost and decline any claim that's not completely clear; another prefers to focus on customer satisfaction, so it pays even when a claim is in the gray area. Insurers might assess fraud risk differently and make different decisions about who to refer to the fraud department. Automating these decisions means more options for outsourcing. You don't have to be concerned about where or how a process takes place; you control it by controlling the decisions that drive it. Figure 1, for instance, shows a process for a claims-processing organization; the process steps are the same for clients. Each client needs to define different rules for the 'Assess Claim' decision. If the decision is controlled independently, the process seems customized, even though the steps are common for everyone, because each organization controls which claims are routed to which activity.

Figure 1. A simplified claims payment process showing key decisions.

[Sidebar 4. Fast-Growing Eastern European Banking Group: Collections and Recovery ]

Strategic Alignment

As stated in a Harvard Business Review study,[1] "Most devastating, 95 percent of employees in most organizations do not understand their [organization's] strategy."

One of the advantages of an EDM approach is the opportunity for real strategic alignment, top to bottom. At first sight, this advantage might seem contradictory with the focus on operational, high-volume decisions discussed earlier. If enterprise decision management is focused on operational decisions, how can it contribute to strategic alignment? Many organizations are challenged to keep their operational activities -- the way front-line workers operate and the way self-service applications behave -- synchronized with their strategic plans. This synchronization can have results such as the following:

- You might want to treat all gold customers a certain way but have a self-service application that doesn't differentiate between customers.

- You might want to get more aggressive about retaining certain customers but have call center representatives who have too many campaigns to remember, so they treat everyone the same.

- You might want to offer demand-based pricing, but your Web site is disconnected from the demand algorithms sales representatives use.

Divergent agendas and miscommunication between those working on an organization's strategy and those carrying it out it operationally are chronic problems. These disconnects can hinder executive leadership's access to information about what's really going on and their ability to effect change in organizational behavior when needed. No performance management infrastructure in the world can solve this problem; you just have a real-time, accurate view of how badly it's going.

Using enterprise decision management to align strategy and operational decisions can help you reduce inefficiencies and improve effectiveness. For example, an EDM system can help brand managers assess and improve the alignment between promotional campaigns used in the call center, mailing house, and Web site and the overall marketing strategy. An EDM application that manages customer retention decisions could make sure that the right retention offers are made to the right customers regardless of channel (call center, store, agent, and Web site). It also ensures that these offers change as quickly as the strategy does. By focusing on operational decisions that implement the strategy on the front line, automating those decisions, and giving business leaders control over how to make these decisions, you can dramatically improve the alignment between strategic intent and operational reality. Figure 2 shows how separating out the decision logic in a decision service allows frequent changes to support a changing strategy without the need for repeated programming projects.

Figure 2. Enterprise decision management ensures that decisions affecting interactions remain in sync with market and other changes.

Another basic issue in strategic alignment is secrecy. The top levels of organizations, where strategy is concocted, often hold information close to the vest, with the idea that it's confidential, proprietary, and a competitive advantage. Some strategies, such as being aggressive about raising prices, are kept quiet because they might cause bad public relations. Although you can criticize this thinking, it's understandable. The problem is how to keep strategy confidential yet let it influence the way every employee (or system) interacts with your associates.

Taking an EDM approach to focusing on key operational decisions -- those made by the most junior staff (the ones furthest from the company's strategic heart) or by information systems -- allows those who understand the strategy to control how decisions are made without having to tell everyone the strategy. For instance, if retaining profitable customers is a critical issue, you can devise a model to estimate customer retention risk and embed the prediction into rules that handle making retention offers. When data suggests a change is needed, business managers can decide on a new strategy ("get more aggressive about customer retention") and turn it into rules to "make it so." With this method, you have front-line workers who still don't know the strategy, but the strategy drives their interactions with customers. Their interactions are informed by the same analysis of the business yet are agile enough to respond to changes as they are made.

Risk Management

Many interactions with customers involve risk assessment as part of deciding how to treat them. If you're going to offer customers credit, you have to assess the risk of them becoming a bad debt and going into collections. If you're about to target delinquent customers with an attempt to recover money they owe you, you risk them ceasing to be profitable customers in another product line. When you're pricing auto insurance for customers, you must assess the risk that they will have an accident. When you submit orders to suppliers, you must consider the likelihood of on-time delivery. When you schedule a package on a truck, you're assessing the risk that the truck will arrive when the package is promised.

The precision with which you can calculate risk and apply it to pricing, scheduling, and marketing has a direct impact on the effectiveness of your business. In pricing, if you underestimate risk, you charge too little and risk incurring more expense than you could justify; if you overestimate risk, you might lose a customer to a competitor offering a better price. In general, organizations that can segment types of risk more accurately and precisely than their competitors have better control over risk in their business. This control might result in better on-time deliveries, fewer product quality problems, or just more revenue.

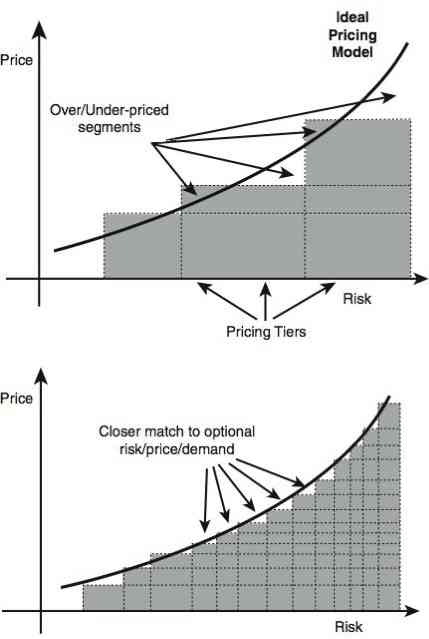

Risk is normally managed by using tiers -- levels of risk corresponding to different prices. Having fewer, less-specific risk tiers than competitors can result in what's called being "adversely selected against." Say you have three segments and your competitors have six. Their two highest risk segments compete with your single highest risk segment. Assuming similar pricing models, your price for this segment is likely to be around the average of your competitors' two segments. This pricing tends to mean that prospects in the lower risk half of your segment get a better price from your competitors, and prospects in the higher risk half of your segment get a better price from you. The result is that your customer portfolio is more risky and less profitable than your competitors'.

More pricing tiers or customer segments means that your actual price matches the theoretical 'best price' curve more closely, as shown in Figure 3. This translates into prices that accurately reflect your risk and allows you to attract customers at a price that meets your risk profile.

Figure 3. More customer segments allows a closer match to an ideal risk-based pricing model.

(c)Fair Isaac Corporation, reproduced with permission

In theory, risk-based pricing can be done by hand. In practice, however, people do a good job of discriminating between segments only when there are a few -- fewer than seven, say. If you need dozens or hundreds of risk segments, you'll find that people have some favorites and use them if they can. People do a poor job of handling the large number of variables required to segment very specifically. Only by applying automation to this decision can you take advantage of precision in risk assessment.

[Sidebar 5. Too Many Segments ]

A focus on risk management can also be applied to considering opportunities. Precision in maximizing opportunities can be achieved in a similar way to risk management. Instead of considering the risks involved in a decision, you can consider the opportunity of a decision. If attracting a new customer is worth a certain amount of revenue, you should invest only a comparable amount in acquiring that customer. Targeting prospects correctly generates more revenue, decreases waste, and manages your opportunity risk.

Knowledge Retention

Although knowledge retention isn't related directly to the impact of automating decisions, it might turn out to be one of the longest-term strategic benefits of using enterprise decision management. As companies watch experienced professionals retire and face new, younger workers unwilling to take on some traditional roles, they need a new solution. Capturing expertise as rules, generating formal risk and other models from historical data, and using these rules and models to automate decisions helps keep that knowledge in the organization and makes the remaining job (absent the rote approvals) more interesting and desirable. The retirement of expert staff has long been an issue, but the baby boomers will make the problem more noticeable than ever. Although capturing expert knowledge as documents or guidelines can help somewhat, only automating it addresses the issue that incoming workers might not want the same jobs the retiring workers had.

References

[1] Robert S. Kaplan and David P. Norton. "The Office of Strategy Management," Harvard Business Review OnPoint. (October 2005). ![]()

| Acknowledgement: This material is from the book, Smart (Enough) Systems, by James Taylor and Neil Raden, published by Prentice Hall (June 2007). ISBN: 0132347962. |

# # #

About our Contributor(s):

Online Interactive Training Series

In response to a great many requests, Business Rule Solutions now offers at-a-distance learning options. No travel, no backlogs, no hassles. Same great instructors, but with schedules, content and pricing designed to meet the special needs of busy professionals.