The Need for Smart Enough Systems (Part 10): Costs of Enterprise Decision Management

You should never consider benefits without some matching discussion of costs. Costs for enterprise decision management can be for software, people, or organizational change.

Most companies implementing enterprise decision management need to buy additional software. Although building an infrastructure to manage decisions with an EDM approach is possible, purchasing a business rules management system is more realistic.

Even companies with a major investment in an 'analytic' infrastructure might find they need to buy additional software. Many business intelligence and business analytic platforms don't have the algorithms needed to build sophisticated models or the technology to deploy these models. They focus on reporting and supporting manual analysis. In addition, they build on a data warehouse infrastructure that's too latent and designed for reporting, not insight. Some products in this category are add-ons to more traditional business intelligence software; others are stand-alone environments designed to turn existing data into executable models.

Building systems with the adaptive control and learning infrastructure an EDM approach requires also means new code, new components, and new software infrastructure in addition to analytic and business rules components. Although none of these approaches is a dramatic departure from traditional software development practices, making them part of the standard IT operating environment incurs extra costs. In Chapter 4 of our book we discuss the technologies typically required to implement enterprise decision management.

[Sidebar 1. Controlling Risk While Doubling Customer Base ]

As with any new products, you must also consider training and support costs. Developers need training in how to think about business rules, manage them separately from requirements, and develop and test them. Some business analysts will benefit from similar training. Business managers also need training on how to think about more formal logic and on interacting with programmers. Some organizations find they need additional business resources to manage rules when programmers stop doing so; they still save on the number of programmers needed, but there is to some extent a transfer of head count from IT to the business. Business rules are a new approach for many organizations, so support and mentoring can increase the chance of success at an additional short-term cost.

Similarly, on the analytic front, companies might need to hire analysts as staff or consultants. Even organizations with experienced analysts often incur training costs. The focus on deploying executable models is likely to be new, even for those experienced in analytics, and supporting analysts to make this change in approach matters a great deal to overall EDM success.

More sophisticated analytics might impose additional costs for data. The use of external data, often available at a fee, can dramatically improve the ability to model some customer characteristics, for example. These costs might be incurred once but are more likely to become a regular transactional cost, because data is used in each decision made.

Last, organizational change always costs time and money. Assuming that change can simply be imposed instantaneously without a change management process leads to problems. Time and money must be devoted to getting IT people, analytics people, and businesspeople to change their mind-set and approach to an EDM one. It's best to adopt enterprise decision management in phases, with each showing a clear ROI. In Chapter 9 of our book we cover this topic in more detail.

Introducing Decision Yield

If you can't manage what you can't measure, you need a new measure for decision effectiveness so that you can manage decisions. Sometimes organizations find that their established cost/benefit analysis doesn't show the true value of enterprise decision management. By comparing organizations that have adopted enterprise decision management with those that haven't, you can identify some clear differences in the way they make investment decisions. In particular, there's more focus on revenue improvement and opportunity costs (costs implicit in a delayed response to an opportunity). The challenge is how to turn a broader focus into a justification for EDM investments. Decision yield is a new approach that can be effective.

Decision yield is a broad evaluation metric that reveals the quality of your current decisions and decision processes and helps you plan, justify, and measure improvements to decision processes. Frank Rohde first described the need for it:[1]

"We judge leaders by how well they make big, strategic decisions. But corporate success also depends on how well rank-and-file employees make thousands of small decisions. Do I give this customer a special price? How do I handle this customer's complaint? Should I offer a seat upgrade to this customer? By themselves, such daily calls -- increasingly made with the help of enterprise decision management technology -- have little impact on business performance. Taken together, they influence everything from profitability to reputation."

What constitutes a good decision? Is it the outcome alone? The cost of carrying out that decision? The speed of making the decision? How about coordinating several decisions across different parts of your organization? In reality, all these aspects are likely to be important. Without a consistent method for measuring the performance of high-volume, operational decisions, you might make plans for vital improvements based on metrics that focus on only one dimension of the decision process, such as cost savings. Organizations with such a narrow focus often miss the potential value of an EDM approach.

To determine what constitutes a 'good' decision process and measure the current state of your decision process, you must understand the different facets of an operational decision that contribute to business performance. Decision yield is a holistic way of evaluating decisions specifically designed to evaluate automated decisions suitable for automation and management using an EDM approach. Decision yield, then, can be an effective tool for those evaluating enterprise decision management and trying to decide where best to apply it.

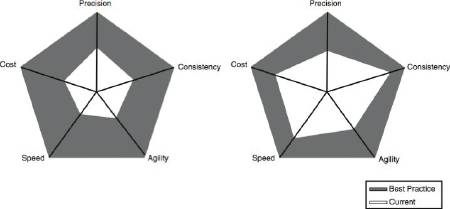

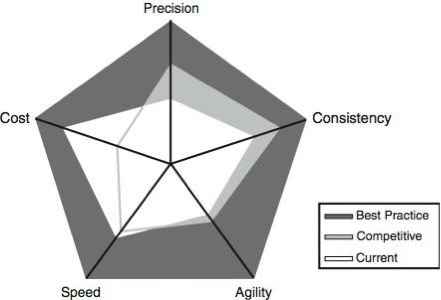

Decision yield's holistic approach involves comparing the following five dimensions of decision effectiveness to make a comprehensive assessment of an operational decision:

• Precision. How targeted and profitable is the decision?

• Consistency. How consistent across divisions, channels, and time is the decision?

• Agility. How quickly can you effectively change how the decision is made when you need to?

• Speed. How quickly can you make the decision?

• Cost. How much does it cost you to make the decision?

Plotting these dimensions for current state, competitive average, and best practice on a 'radar' graphic like the one shown in Figure 1 can be informative. This graphic shows that the company has real strength in cost (offering lower cost than its competitors) and reasonably competitive speed, but its precision and, to some extent, consistency leave it vulnerable.

Figure 1. Radar graphic showing a decision yield for a specific decision

There are many ways to use decision yield to measure decision ROI. You can conduct a decision audit to see how well you perform in relation to competitors or the overall market. You can measure decision yield over time to monitor and optimize performance. You can consider the potential gain in decision yield from different opportunities as part of evaluating which ones to consider. Each is explained in more detail in an Appendix of our book — "Decision Yield as a Way to Measure ROI" — which includes more information on the approach in general.

[Sidebar 2. Multiline Insurer: International Mid-market Trade Credit ]

To see how decision yield can be effective, take a look at Figure 2, which shows two examples of a decision yield audit for U.S. insurance companies that resulted in very different recommendations. The two decision yield charts were developed based on their responses. Company 1, on the left, shows generally weak results on all five dimensions of decision effectiveness. This result isn't surprising, because the company had historically competed with a small group of insurers who were equally weak. Comparing decision making against national competitors clarifies obvious weaknesses. Company 2 (a nationally competitive insurer), on the right, has much better results. However, its weakness in precision compared to competitors might make it vulnerable to competitors who manage risk-based underwriting decisions better, and its lack of agility exposes it to risks in a fast-changing market.

Figure 2. Decision yields for two insurance companies' underwriting process

You can also consider specific notes and suggestions made to these companies based on their decision yield assessments, as shown in Table 1.

Table 1. Results for Each Dimension for Two Companies

Dimension |

Company 1 |

Company 2 |

Precision |

Its reliance on manual underwriting by agents without widespread use of predictive analytics means its precision was only average compared with national competitors. It has few pricing tiers, for instance, over time. |

It rates strongly in precision, although behind industry leaders. This dimension is a major focus, and its weakness comes from its inability to learn and adapt its risk models. |

Consistency |

Manual underwriting weakens its consistency scores. Although the company sells a standard set of well-established products, introducing new products and managing them consistently are difficult, especially if the company introduces new channels. |

Company 2's consistency is nearly perfect, with only a few problems with agents repricing policies before issuing them. Consistency is clearly a strength. |

Agility |

Agility is low as a deliberate policy; this company prides itself on not chasing trends. Sometimes decision yield simply clarifies underlying approaches, such as this policy. This score reflects the legacy systems used to achieve the speed the company has. |

Company 2 rates agility very highly but scores at a moderate level. This gap represents a risk to its precision score because failing to respond quickly to change would decrease precision |

Speed |

As expected with a manual process, Company 1 performs poorly on speed, especially because processing is handled in batch. With more competitors offering online, real-time quotes, this lack of speed is a potential source of risk. |

The speed with which underwriting decisions are handled is almost best in class, but the company doesn't seem to have used this dimension to promote itself to agents or customers. |

Cost |

The manual process is expensive, and this cost is being passed on to the company's agents. It isn't clear how long agents would tolerate this practice or how easily a competitor could use it to attack their agent network. |

Company 2 has an excellent cost rating, which is reflected in a very low expense ratio. Being low cost isn't a specific strategy, however, so the decision yield review made it clear the company could sacrifice some of its cost rating to improve other dimensions, such as agility. |

The Appendix has more information on how to measure and interpret decision yield results. This technique is just starting to be used in a formal sense but early results, such as those described here, show great potential.

References

[1] Frank Rohde. "Little Decisions Add Up," Harvard Business Review (June 2005). ![]()

| Acknowledgement: This material is from the book, Smart (Enough) Systems, by James Taylor and Neil Raden, published by Prentice Hall (June 2007). ISBN: 0132347962. |

# # #

About our Contributor(s):

Online Interactive Training Series

In response to a great many requests, Business Rule Solutions now offers at-a-distance learning options. No travel, no backlogs, no hassles. Same great instructors, but with schedules, content and pricing designed to meet the special needs of busy professionals.