Moving to Predictive Analytics in Decision Management

Last month I started talking about using data in decision management — the mining of data to make rules better. This month I will talk about the next step in using data, moving to predictive analytics. Recapping,

Enterprise Decision Management is an approach for automating and improving high-volume operational decisions. Focusing on operational decisions, it develops decision services using business rules to automate those decisions, adds analytic insight to these services using predictive analytics, and allows for the ongoing improvements of decision-making through adaptive control and optimization.

Let's consider how this might work in a specific scenario — customer retention. A typical retention scenario involves making retention offers across multiple channels each with different systems and platforms. This gives us a high risk of inconsistency — the retention decision we make is likely to be inconsistent across channels — and is generally sub-optimal. The first step is to focus on the retention offer as a decision and then automate it with a decision service and, obviously, we want to build it with rules makes to make it more flexible, more agile, and more business-centric.

We can use the approaches we discussed last month to use the data we have about customers to improve our decision making. For instance, there are many different kinds of customers for whom different offers make sense so we could analytically derive some rules to segment and target our customers. So far so good — rules-based decisions informed by the data we have about customers.

Now, if only we knew who was a retention risk and who was not, we could do a better job of making offers. We could spend our money on making retention offers to those customers who are at risk, for instance, not those that will stay anyway. But to be effective we must make retention offers before a customer decides to leave — when their decision to quit is in the future. But the future is uncertain so how can we target customers who will decide to leave in the future?

Enter predictive analytics. Predictive analytic techniques analyze current and historical data to make predictions about future events. These are rarely absolute statements ("Customer X will not renew at the end of this contract period") but are more likely to be odds of a particular event taking place in the future ("Segment X is those customers twice as likely to cancel as renew"). Using these techniques allows us to turn uncertainty into probability — from not knowing who is a retention risk to being able to estimate roughly how likely someone is to be a retention risk.

The process for building these kinds of models go like this:

- Find the outcome you want to predict.

Always start with the end in mind — a business outcome. You have to be able to predict something useful and do so early enough to take action. You must consider timeliness, accuracy, operationalization, time horizon, and more.

- Find data that might help you.

Don't just use the data you already have; think about data you could buy, gather from surveys, start capturing for the future.

- Prepare, clean, and split it.

What you need is data that is consistent (in its use of codes, for example) and of known accuracy. You also need to have it split into training, validation, and test data.

- Analyze training data using regression, classification, neural nets, genetic algorithms, or other techniques.

The techniques themselves are beyond the scope of the column, but there are many and it is typical to try multiple techniques for each problem to see what works.

- Build a model.

The model might be represented by a formula (regression and neural network models, for instance) or a scorecard (of which more later).

- Validate it using validation data.

Some of the data you kept out is used to make sure you model makes sense.

- Test for usefulness using the test data.

The final set of data is used to see if you can actually make useful predictions.

Then, of course, you have to deploy it. An increasing number of Business Rules Management Systems support the integrated deployment of analytic models, and many analytic modeling tools will also deploy the models as services that you can use.

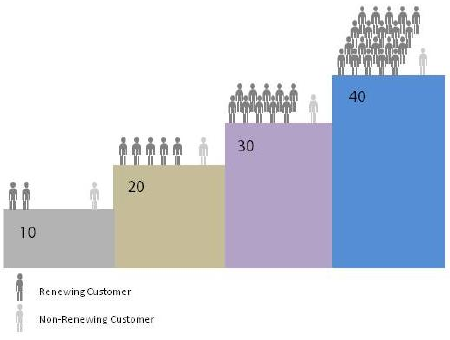

One of the most common ways to use predictive analytics is to rank-order individuals. In the example below, a customer with a renewer score of 10 is twice as likely to renew as to not renew, while a customer with renewer score of 20 is 5 times as likely to renew as not; one with a score of 30 is 10x, and one with a score of 40 is 20x. Knowing this allows you to treat customers more appropriately, based on their renewal risk. The higher the score, the more "renewers" for every "non-renewer". Note that this involves the risk or opportunity in the context of a single customer or transaction not an overall pattern.

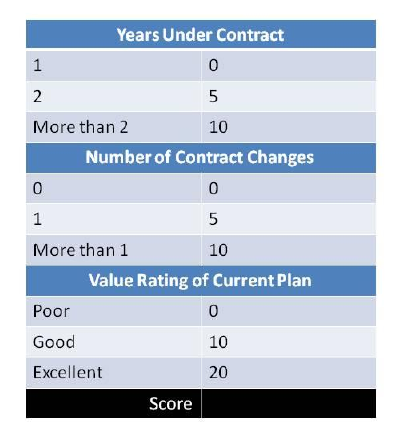

One of the most effective ways to bring predictive analytics into decision services built on business rules is through the use of score cards or additive score cards. A variant of decision tables, these represent a collection of rules that "score" a particular customer or transaction depending on the value of specific attributes. In the example below, for instance, being under contract for 2 years or more adds 10 to your renewer score. Your total score can easily be calculated from the various elements of the score card. The trick, and the power of predictive analytics, is to find out which attributes make a difference and what values for those attributes predict the behavior about which you care.

Score cards are popular because they can easily be executed as a set of rules, because they are transparent and easy to review, and because they are a format long familiar to analytic developers.

# # #

About our Contributor:

Online Interactive Training Series

In response to a great many requests, Business Rule Solutions now offers at-a-distance learning options. No travel, no backlogs, no hassles. Same great instructors, but with schedules, content and pricing designed to meet the special needs of busy professionals.