Commercial Insurance Carrier's Road to Business Agility

Introduction

For a good part of the 20th century, the approach to underwriting and setting insurance premiums relative to risk (i.e., pricing) in P&C commercial lines remained relatively unchanged with companies generally using a few rating variables to set base rates for individual lines of business supplemented by discretionary credits and debits based on their internal underwriting guidelines. This approach did not offer much in the way of differentiation, price competitiveness, or consistency in the underwriting decision-making process.

Following in the footsteps of the personal lines market, over the past five to ten years commercial P&C insurance carriers have widely adopted predictive analytics as a core business strategy to improve pricing precision, underwriting consistency, and customer segmentation. Deeply rooted in actuarial principles, commercial lines predictive analytics ("PA") has evolved from a singular underwriting application to multiple business applications supported by information technology.

Despite these advances, a great deal of subjectivity in information processing and decision making remains within various commercial lines operations, hindering insurance carriers from taking an enterprise view and optimizing PA power. While navigating one of the most challenging economic times in history, compounded by a soft market, commercial lines market leaders will be those organizations capable of processing information, reacting to insight, and making consistent decisions better and faster than the competition.

Background

Nearly 20 years ago, the correlation of credit scores and personal auto insurance loss opened the door to an innovative approach to pricing and underwriting insurance risks in personal lines. The application of PA — or the process of analyzing and exploiting signals in historical data to predict a future outcome that is actionable — offered promise for a better way to price personal lines insurance products. Today, the application of PA to improve pricing precision and automate the underwriting process is a mainstay and a pre-requisite to compete in personal lines. PA combined with business rules management has transformed the way personal lines insurance carriers make underwriting and pricing decisions. While market leaders have evolved the art and science of PA through new socio-demographic variables and extension into other business operations, they have not always done an effective job of integrating these insights into a broader data management, business intelligence, and decision management strategy.

A similar trend has taken place in the commercial insurance marketplace with one key difference — the use of PA insights in day-to-day operations. In personal lines, PA is used primarily to improve rating plans and pricing. In commercial lines, it is seldom used to alter rating plans but rather it supplements existing rating plans through improved underwriting precision.

While the commercial lines approach provides several benefits and does not require filings of revised rate plans, it introduces significant risks resulting from subjectivity and inconsistency. The underwriting decision-making process is inherently a subjective process with a great deal of traditional variability and inconsistency in the process and application of underwriting guidelines. While we believe it is clear that the role of underwriters will continue to be vital, opportunities exist to maximize insights gained from predictive analytics through automated and consistent rules-based decision making within a carrier's book of business.

As this combination of art and science evolves in commercial lines, carriers are seeking new applications for PA including claims, marketing, customer acquisition, customer service, premium audit, fraud detection, and loss control. Combined with investments in technology and migration of legacy systems to service oriented architecture and web based applications, significant opportunities exist to interface across internal operations and external customers. Simultaneously, a greater need for implementing an enterprise decision management framework arises. PA is no longer a 'nice to have' in commercial lines but is a requirement for companies to survive and thrive in today's competitive market. As more and more companies implement this solution to support core insurance operations, these capabilities alone will not offer market differentiation. In order to succeed in staying one step ahead of the curve, commercial lines market leaders must have the ability to make timely, consistent, and better PA-enabled decisions.

The Building Blocks

The use of predictive analytics by commercial insurance carriers in core operations is the first step in profiting from one of its most important assets — data. The very nature of this solution alone does not translate into immediate financial benefits unless consistent PA-derived decision making is implemented as part of the solution roll-out. A PA solution implementation is more than just developing usage strategies in a consistent manner — it also includes the necessary technical infrastructure, business process redesign, training, and change management to fully integrate consistent decision making within the heart of the business. Getting there, however, is no easy task. Before an enterprise PA-enabled decision management strategy and framework can be implemented, commercial insurance carriers must first learn to manage their data. Data collection, quality, and management are often viewed as the first step in the road to building business agility.

During the process of developing PA solutions, companies have an opportunity to gain insight from their data that transcends the spectrum of previous usage. The initiative should be much more than an opportunity to develop a specific business application that leverages and exploits signals in data that are predictive of some future actionable outcome. Rather, over the course of developing and implementing PA solutions, commercial insurance carriers can gather the necessary intelligence on how they collect, manage, and act on data that can be incorporated into a broader data management strategy. Carriers capture a lot of data; some do it better than others. During the development of a PA solution, they learn the value of some of the information they capture, but they also learn that some of the information they capture has little or no predictive business value. The analysis of a company's internal data can shed additional insight into the risk characteristics of the insured, or it could be of little use if the quality of the data is poor. By better assessing the need for data and its corresponding role in the flow of data, companies can avoid making repeat data collection and data quality mistakes, improve the ease of doing business by streamlining the information collected from its customers, and position itself for more robust 2nd-, 3rd-, and 4th-generation predictive analytics solutions.

Becoming Agile

The culmination of a PA development effort for commercial lines insurance can take anywhere from four to eight months, depending on the efficiency of data extraction and data processing, the choice to use internal or external resources, and the degree to which multiple stakeholders within the organization are engaged throughout the process. Upon completion of a PA project, insurance companies are often presented with graphical "lift curves" that demonstrate the potential segmentation power of the developed solution. These graphics typically generate a lot of excitement and sighs of relief as they serve as certification of a job well done. But are they the mark of success? Statistics have proven time and time again that predictive analytics — or the process of examining historical data to predict the future — works very well from a purely quantitative perspective, but it is the quality of the institutional practices carriers use daily to realize business value that make the difference in the long run.

There are a variety of ways that commercial insurance carriers implement PA within core insurance operations to support day-to-day decision making. Approaches include varying degrees of automated decision making, enterprise wide implementation, and integration sophistication. The degree to which PA is used in the decision-making process from supplemental information to rules-based decisions also varies.

One approach that is helping commercial lines insurance carriers extend predictive analytics across the enterprise and maximize return on their project investment is enterprise decision management ("EDM"). While there are a variety of definitions for EDM, EDM is often referred to as strategy, process, and technical infrastructure that enables enterprise-wide automated decision making across all stakeholder touch points — employees, customers, and suppliers. EDM is often used in conjunction with business rules management ("BRM") and business process management ("BPM") as part of an organization's overall automated decision management strategy through rules-based systems.

In today's soft insurance pricing market and distressed economic environment, the need to "get it right" when implementing PA becomes even more urgent. Today, PA is commonly used not only to support underwriting but also other key mission-critical business applications. EDM is an opportunity to introduce and mandate consistent decision making across core insurance operations and to institutionalize and standardize the hidden and subjective decision making that is inherent in underwriting, agency management, marketing, and claims management. Given the many forms of business process subjectivity, one could argue that without EDM the value that predictive analytics provides to commercial insurance carriers would never be fully realized.

As commercial insurance carriers continue to seek differentiation in the marketplace, the imperative becomes not only developing better predictive analytics solutions but also strengthening the data building blocks. Improving data collection and data quality, as well as the ability to act on new insights in a consistent, automated manner, are all necessary for better results.

This also holds true for extending PA from traditional underwriting applications to other insurance operations such as claims and marketing. Why invest the time and resources in developing a new predictive analytics solution that could take many months unless the process and infrastructure is in place upstream (to improve data collection and data quality) and downstream (to support automated decision making)? Rather than make large-scale investments in new technologies or new predictive analytics applications, commercial insurance carriers can realize significant benefits from incremental improvements in data collection and consistent decision making.

In the article, "Little Decisions Add Up"[1] Frank Rhode describes the concept of decision yield — or the impact of individual small decisions on an organization. The decision yield approach can be used to measure the value of an individual decision across the following dimensions: precision, cost, speed, agility, and consistency. Employees in commercial insurance companies collectively make thousands of decisions every day and, depending on the job function, each decision is made with varying degrees of subjectivity. Take underwriting for example: even with predictive analytics at their disposal, it is well understood that ten underwriters would likely not evaluate an individual risk the same way, and this would result in disparate pricing for the same risk by different people by the same insurance company. Supplementing predictive analytics with EDM offers commercial insurance carriers the opportunity to introduce consistency and accuracy to decision making and stay ahead of the competition in the road to business agility.

Figure 1.

The Road to Business Agility

Conclusion

Insurance, whether it is personal or commercial insurance, is something we all need but hope we never have to use. In many ways it is a commoditized industry where many companies compete mostly on price and on perceived service. For years, insurance companies have sought ways to price risks more effectively and accurately but the business process has remained largely unchanged. With recent advances in computing, insurance companies now have the ability to improve pricing precision and enhance customer service. PA holds the promise for greater competitive pricing advantage while simultaneously enabling an overhaul in customer service delivery and enhanced data collection and data quality.

As these advances transform the personal and commercial insurance industries, an emerging school of thought and technology is developing around automated decision making. EDM — or the strategy, process, and technical infrastructure components that enable automated decision making across an enterprise — offers companies across all industries a holistic approach to processing information in a systematic manner. While it seems intuitive that EDM and PA are a natural convergence, they are seldom discussed as part of an integrated solution. Taking it a step further, unless a process is in place to consistently and accurately act on predictive analytics insights in an automated manner, the benefits of predictive analytics may never be fully realized.

PA in commercial lines is no longer in its infancy but has evolved to be a necessary core competency among many of top 100 insurance carriers. As the market becomes more and more saturated with predictive analytics, the pricing advantage enjoyed by early adopters no longer exists, as the playing field has been leveled. Insurers are also being faced with soft market and external market pressures, which creates an even greater emphasis on "getting it right" from a pricing perspective.

PA is one piece of a broader strategy for commercial insurance carriers to leverage its most important asset — data. A holistic view of data makes for a powerful position and greater business agility. And an agile company is ahead of the pack, where many significant opportunities lie.

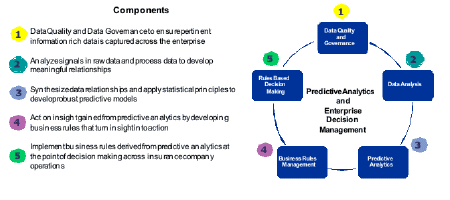

Figure 2.

Predictive Analytics and Enterprise Decision Management

References

[1] Frank Rhode, "Little Decisions Add Up," Harvard Business Review, June 2005. ![]()

# # #

About our Contributor(s):

Online Interactive Training Series

In response to a great many requests, Business Rule Solutions now offers at-a-distance learning options. No travel, no backlogs, no hassles. Same great instructors, but with schedules, content and pricing designed to meet the special needs of busy professionals.